-

Doubling Our Maximum Covered Call Returns Using the Mid-Contract Unwind (MCU) Exit Strategy – December 2, 2024

Our covered call writing trades offer 2 income streams when using out-of-the-money (OTM) call strikes. (Make that 3, if we incorporate dividends into the strategy). These consist of option...

Read More -

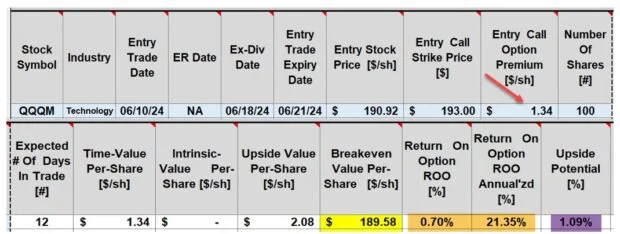

Generating Greater Than Maximum Returns Using Exit Strategies – November 25, 2024

Blue Collar Investors know that there are times we shouldn’t “settle” for maximum returns. In this article, a successful covered call trade with QQQM (an exchange-traded fund or ETF)...

Read More -

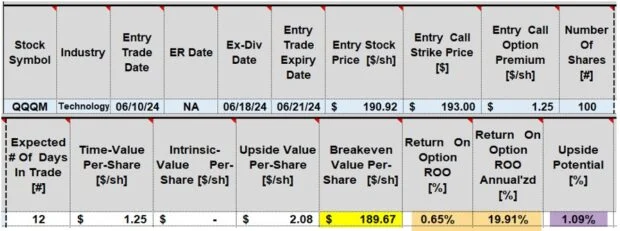

Using Delta to Determine an Ultra-Defensive In-The-Money Covered Call Strike – November 18, 2024

When writing covered calls in bear and volatile markets, we may choose to take a defensive posture and use in-the-money call strikes which offer additional downside protection in the form of...

Read More -

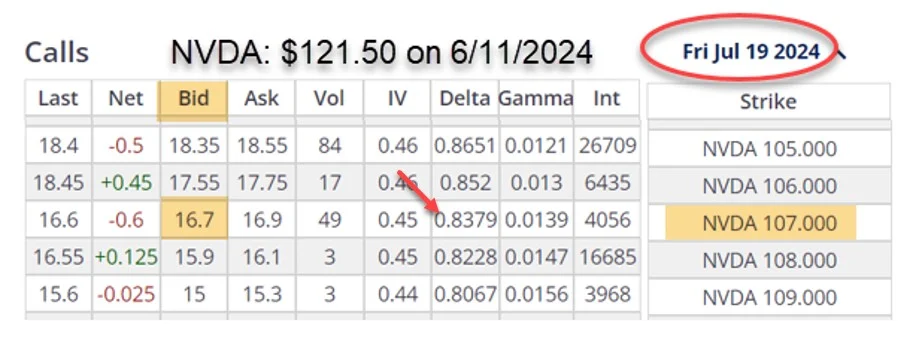

Anatomy of a Successful Weekly Cash-Secured Put Trade with PINS – November 11, 2024

Selling cash-secured puts (CSP) has a goal of generating weekly or monthly cash flow with or without taking possession of the underlying security. This article will analyze a real-life weekly...

Read More -

Rolling a Successful Weekly Covered Call Trade – November 4, 2024

When our covered call trades are expiring in-the-money (ITM), we have an unrealized (shares are not yet sold) maximum return. This consists of option premium + any unrealized share appreciation...

Read More -

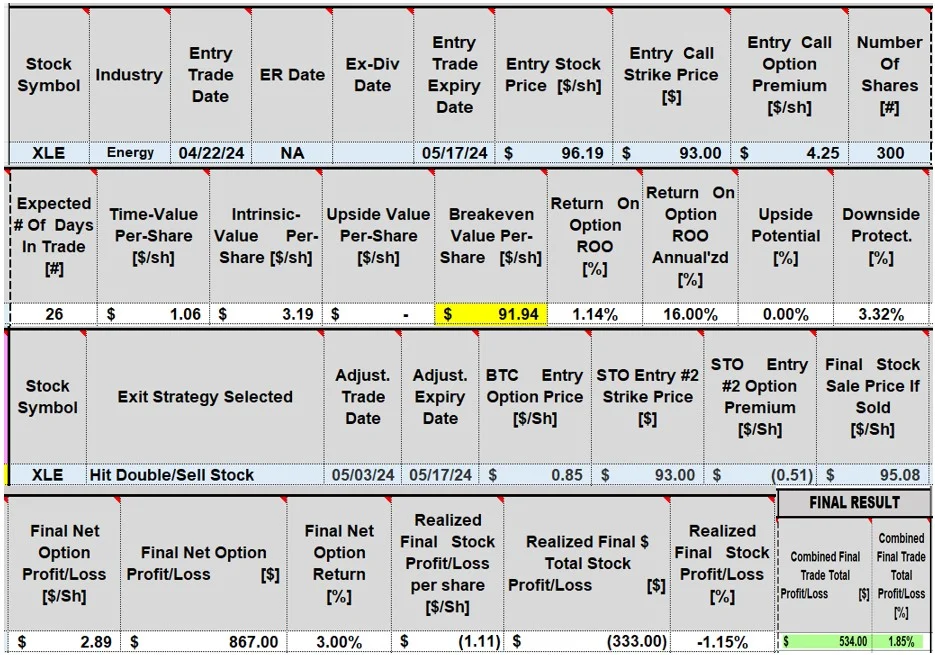

Hitting a Double and Selling the Stock Using the Trade Management Calculator – October 28, 2024

Hitting a Double is a covered call writing exit strategy where the short call is bought back after share price declines and resold when share price recovers. At expiration, we...

Read More -

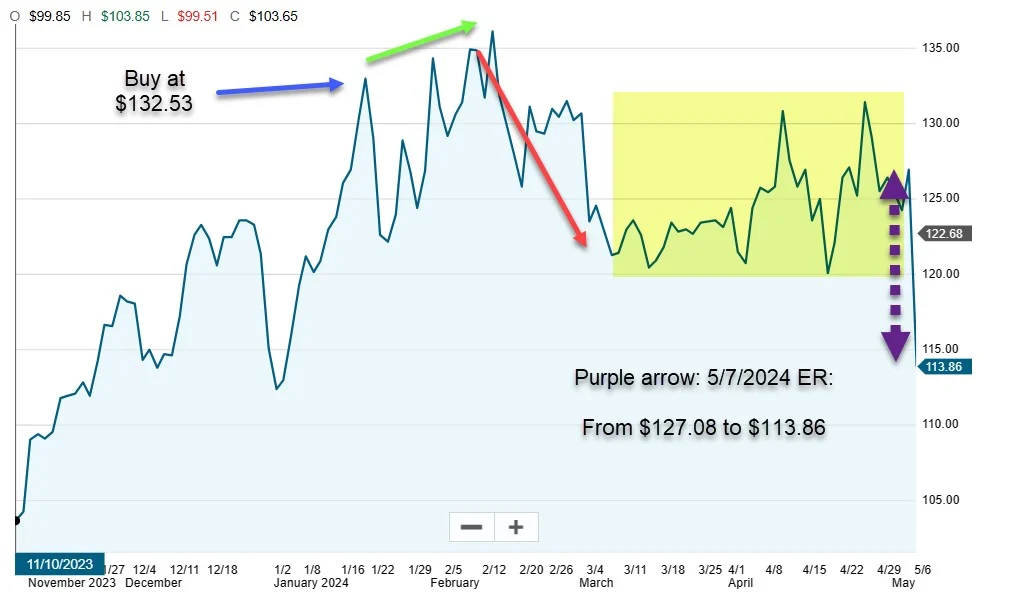

Lowering Our Breakeven Price Points After Disappointing Earnings Reports: The BCI Stock Repair Calculator – October 21, 2024

An important BCI rule is never to write a covered call or sell a cash-secured put if there is an upcoming earnings report … too risky if the report...

Read More -

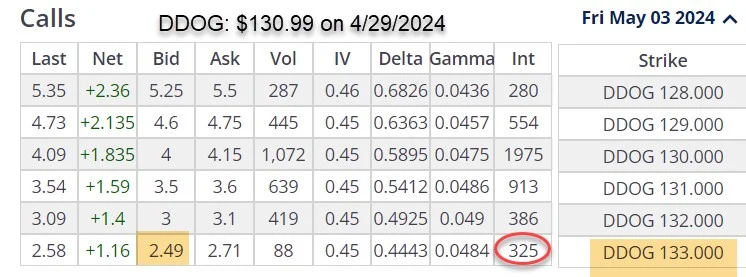

Circumventing Earnings Reports with Weekly Options – October 14, 2024

Always avoid earnings reports when selling covered call or cash-secured put options. This is a BCI rule to protect against serious share price decline after a disappointing earnings release. This...

Read More -

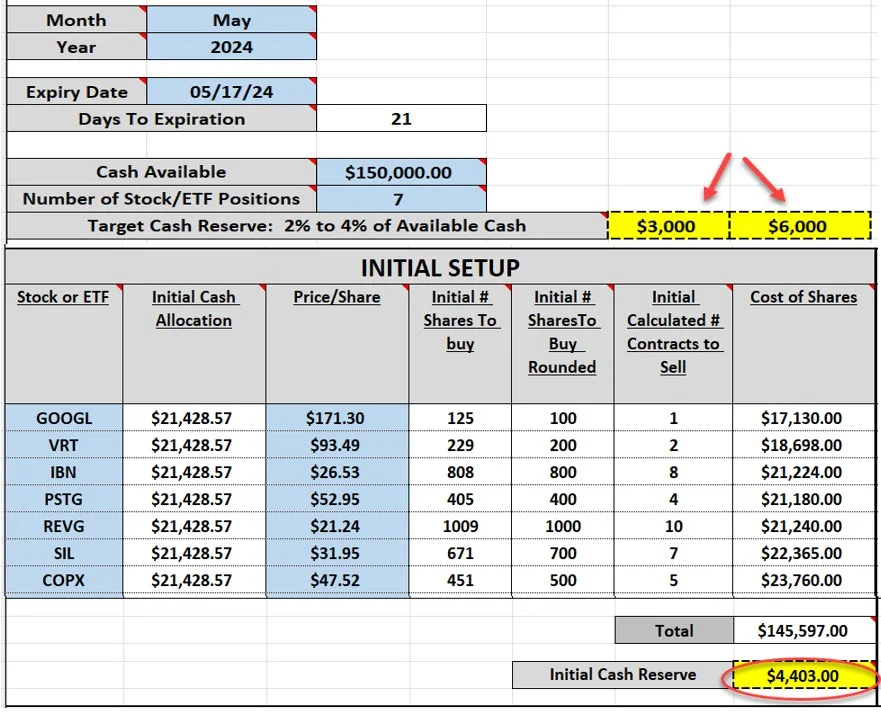

Integrating Cash Allocation into Our Option Portfolios – October 7, 2024

When we construct our covered call writing and cash-secured put portfolios, we must incorporate cash allocation into our investment decisions. In this article, The BCI Portfolio Setup Spreadsheet, the Trade Management Calculator (TMC) and the Premium Stock...

Read More -

Aggressive and Defensive Covered Call Writing Trades – September 30, 2024

When crafting our covered call writing trades, we can do so aggressively, using out-of-the-money (OTM) call options, or defensively, using in-the-money (ITM) strikes. In this article, a real-life example...

Read More