-

How to Best Calculate Weekly Call or Put Trades to Generate Accurate Annualized Initial Returns – September 23, 2024

When we sell weekly cash-secured puts or write weekly covered calls, our trades are, typically, entered on Monday and completed on Friday. This avoids the weekend risk of longer-dated...

Read More -

Can We Make Money Selling Options in a Confirmed Bear Market? / New Video – September 16, 2024

Covered call writers and put sellers frequently inquire about generating positive cash flow when the market crashes or in confirmed bear markets as we had in 2008 (real estate...

Read More -

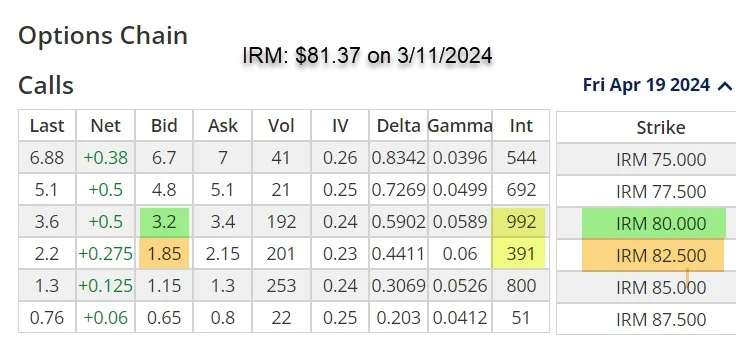

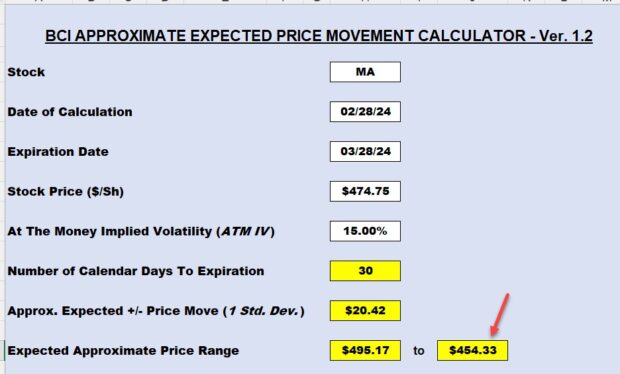

How Our Option Prices are Determined

When we sell covered calls or cash-secured puts, we access option-chains to determine the value of the premiums we are selling. This article will highlight the factors that determine these prices and...

Read More -

How to use the CEO Strategy with Inverse ETFs in Extreme Bear Markets – September 3, 2024

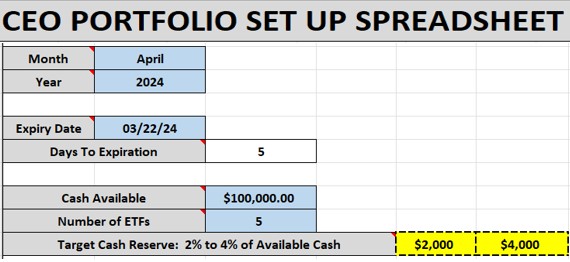

The CEO Strategy is a covered call writing-like strategy, a streamlined approach to covered call writing. It is an acronym for Combining ETFs with Stock Options. It involves using only the 11 Select Sector...

Read More -

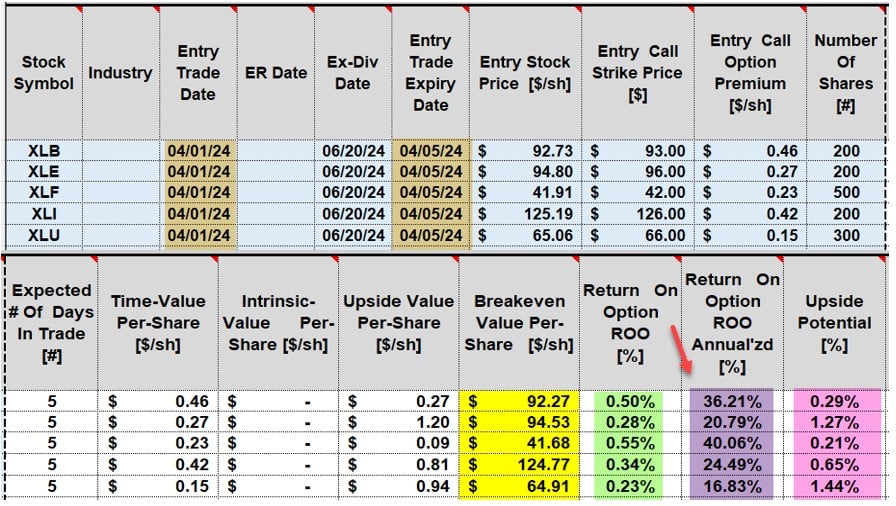

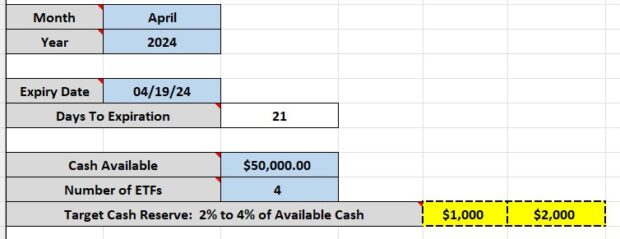

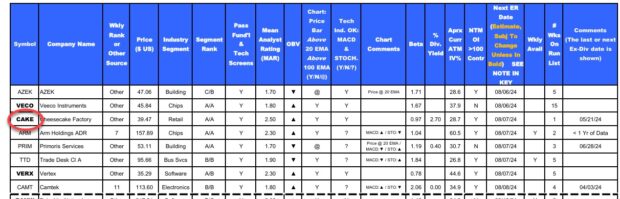

Selling Weekly Covered Calls Using the CEO Strategy – August 26, 2024

The CEO Strategy (Combining Exchange-traded funds with stock Options) is a covered call writing-like strategy where the only underlying securities considered are the 11 Select Sector SPDRs. These are ETFs that...

Read More -

Executing Your First Covered Call Trade – August 19, 2024

Option trading and covered call writing, in particular, have become increasingly popular over the past several years. As our membership has been growing more than ever, we have a large...

Read More -

Bullish & Bearish Covered Call Trade Executions When Selling Multiple Contracts on the Same Stock – August 13, 2024

When selling covered calls or cash-secured puts, we must be appropriately diversified, as well as allocating a similar amount of cash per position. This will protect our portfolios from...

Read More -

Why Wasn’t My Deep In-The-Money Covered Call Exercised? – August 5, 2024

When we write covered calls, our expectation is that if the strike expires in-the-money (ITM), even by $0.01, our shares will be sold at the strike price as a result...

Read More -

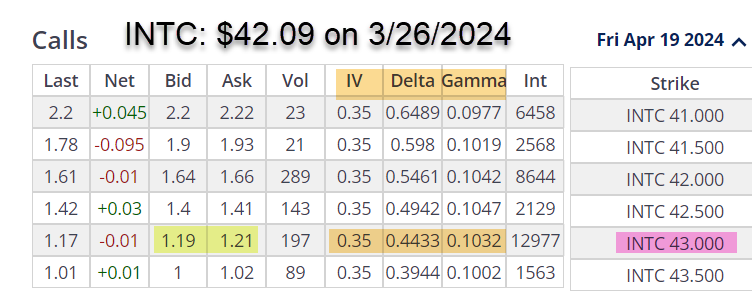

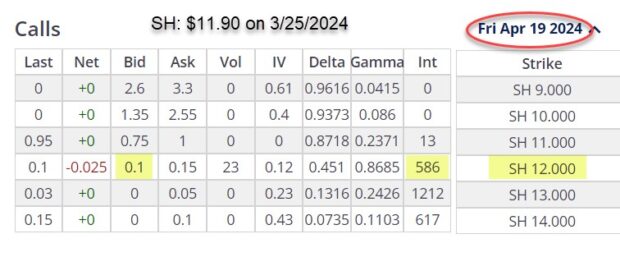

Using Implied Volatility & Delta When Selecting Ultra-Low Risk Cash-Secured Put Strikes – July 29, 2024

When we sell cash-secured puts with the goals of generating cash-flow while simultaneously crafting trades with low probability of exercise, strike selection becomes critical. To accomplish these objectives, we...

Read More -

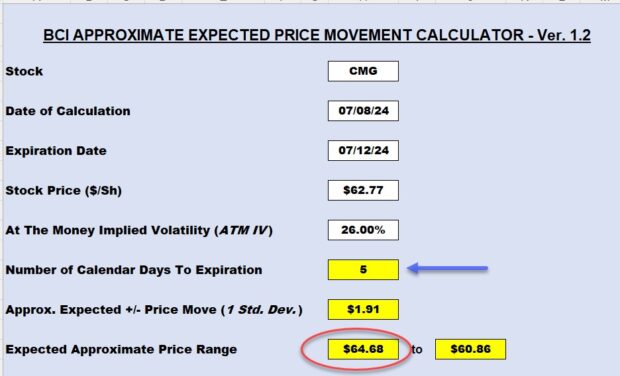

Portfolio Overwriting Weekly Covered Calls with Chipotle Mexican Grill – July 22, 2024

Portfolio overwriting is a covered call writing-like strategy seeking to both generate cash flow and retain the underlying shares. Share retention may be motivated by our bullish long-term assessment of...

Read More