-

My Covered Call is Expiring In-The-Money and I Want to Keep My Shares – July 15, 2024

Covered call writers will frequently find themselves in a position where the short call is expiring in-the-money (ITM), while still wanting to use the same underlying shares for the next...

Read More -

Should I Close My ATM Covered Call with 2 1/2 Months Until Contract Expiration? – July 8, 2024

When our covered call writing trades move deep in-the-money (ITM), the time-value cost-to-close approaches (but does not reach) $0.00. In these scenarios, it may make sense to close both...

Read More -

The Importance of the 3% Guideline When Selling Out-Of-The-Money Cash-Secured Puts – July 1, 2024

On 10/20/2023, a BCI premium member shared with me a cash-secured put series of trades executed with Charles Shwab Corp. (NYSE: SCHW). Over the course of 9 months, SCHW dropped in price from...

Read More -

I Made a Lot of Money, So Why Am I Crying? – June 24, 2024

Covered call writing trades have 2 components: we are long the stock and short the option. When evaluating the success or lack thereof for our trades, we must factor...

Read More -

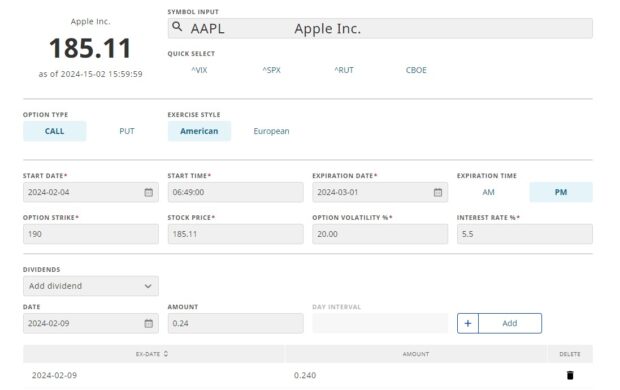

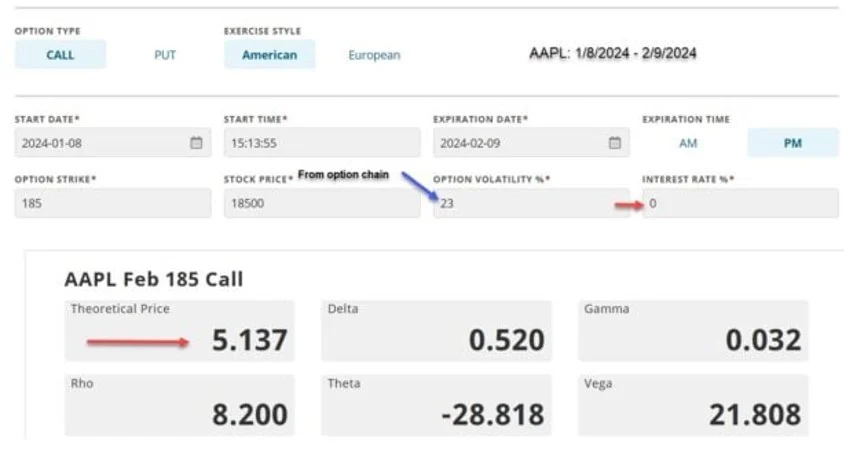

Option Greeks Defined and Theoretical Calculations + Premium Membership Pricing Information – June 17, 2024

The option Greeks are a series of calculations that measure the factors that impact our option prices and risk. The Black-Scholes Model can be used to determine the theoretical value for...

Read More -

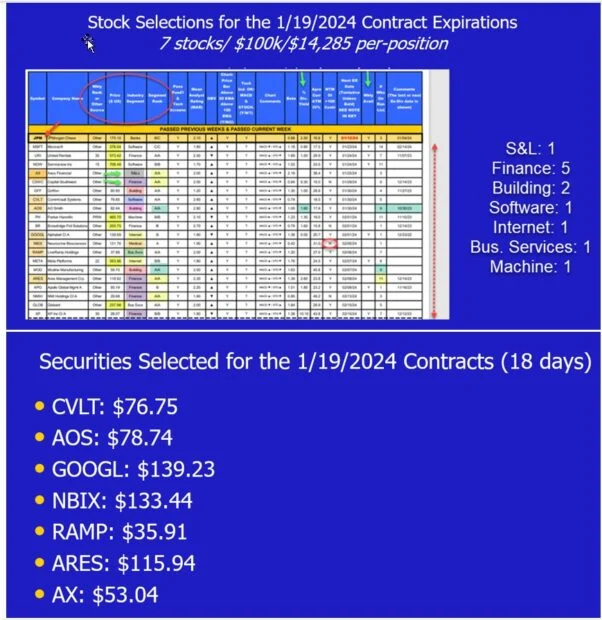

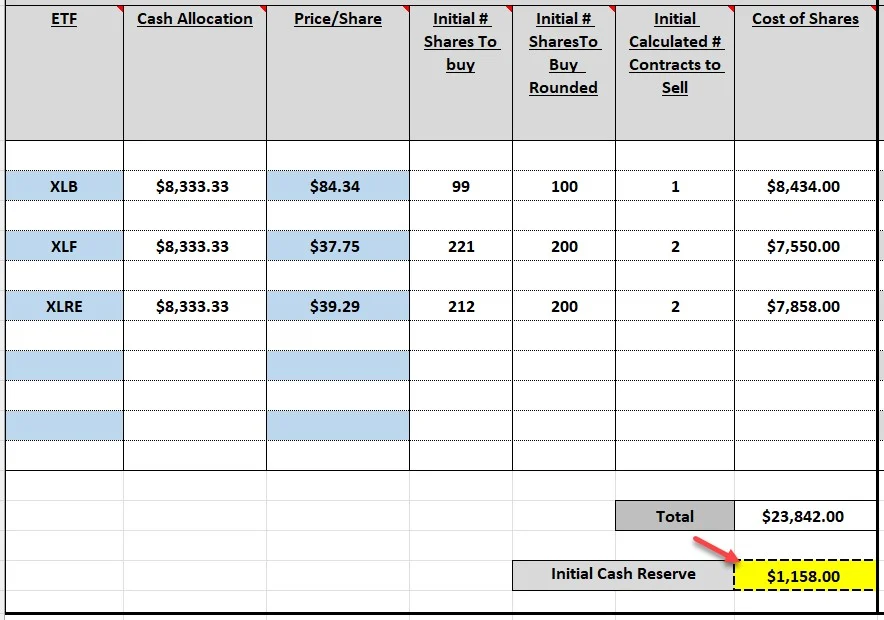

How to Use the BCI Portfolio Setup Spreadsheet to Craft Our Option-Selling Portfolios – June 10, 2024

When establishing our covered call writing and cash-secured put portfolios, it is critical to factor in stock and industry diversification and cash allocation. Our BCI premium stock & ETF reports along...

Read More -

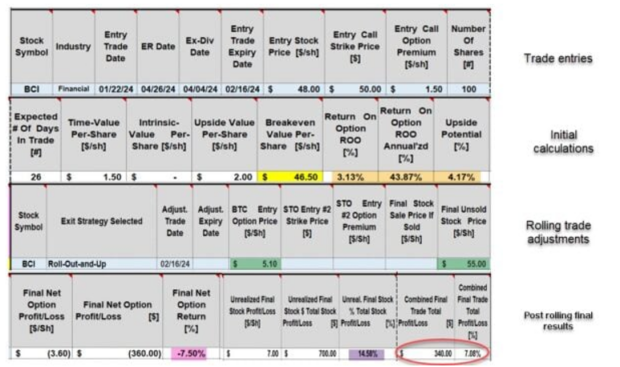

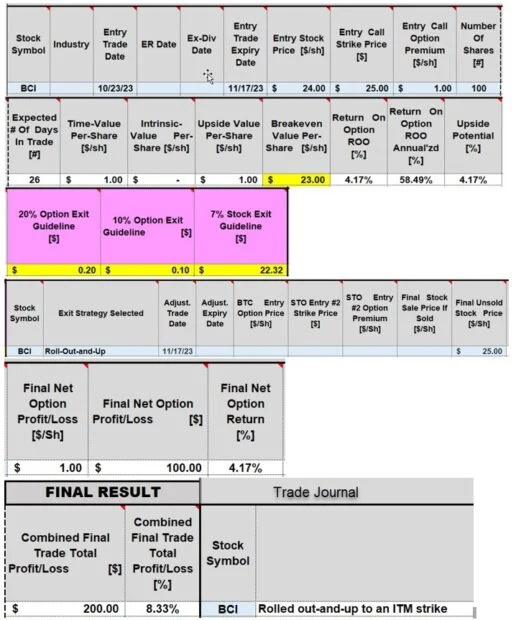

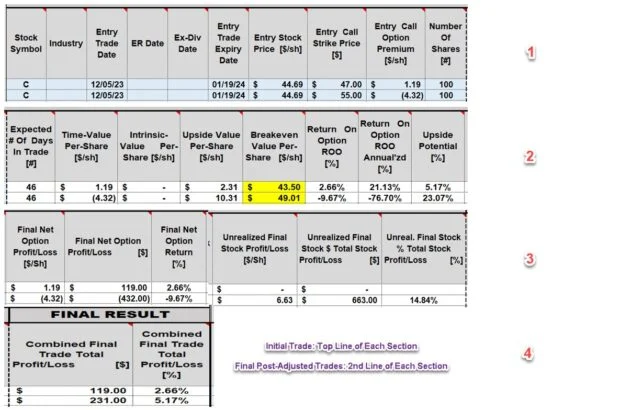

Calculating Our Rolling-Out Trades: 2 Approaches Using the BCI Trade Management Calculator (TMC) – June 3, 2024

When we roll-out our covered call writing trades, the initial strike is in-the-money (ITM) as expiration is approaching and we made a decision to retain the underlying security for the next...

Read More -

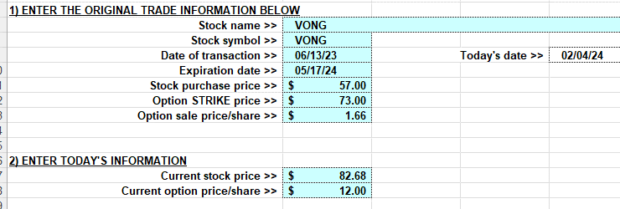

Rolling-Up Covered Call Trades in the Same Contract Cycle – May 28, 2024

We enter a covered call writing trade, and share price accelerates exponentially. What exit strategy opportunities are available, if any? This article will discuss the mid-contract unwind (MCU) and rolling-up exit...

Read More -

Why At-The-Money Calls are Frequently Priced Higher than At-The-Money Puts – May 20, 2024

Intuitively, at-the-money (ATM) calls and puts should be priced the same. In most instances, this is not the case. ATM calls are generally priced higher than ATM puts. Why? The reason...

Read More -

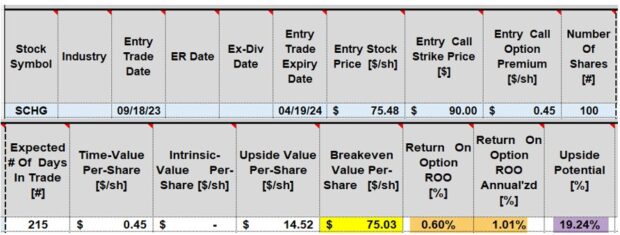

Using the CEO Strategy with a $25k Portfolio – May 13, 2024

The CEO Strategy is a streamlined version of covered call writing, where we use only 11 underlying securities, the Select Sector SPDRs. This article will utilize a real-life example of how...

Read More