-

The Importance of the 3% Guideline When Selling Out-Of-The-Money Cash-Secured Puts – February 26, 2024

On 10/20/2023, a member shared with me a cash-secured put series of trades executed with Charles Shwab Corp. (NYSE: SCHW). Over the course of 9 months, SCHW dropped in price from approximately $83.00...

Read More -

Setting Up a Bullish Covered Call Writing Monthly Portfolio – February 19, 2024

This article will highlight one of the many ways we can establish a monthly covered call writing portfolio during bullish market conditions. We will utilize a hypothetical portfolio of...

Read More -

Summarizing the Information in Our Premium Member Stock Reports – February 12, 2024

When we select a stock for our covered call writing or cash-secured put trades, one of the main resources we analyze in the BCI Stock Reports, crafted starting after...

Read More -

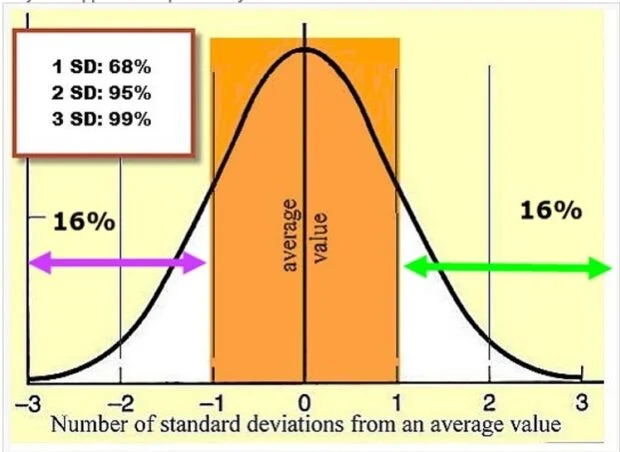

Using Implied Volatility and the BCI Expected Price Movement Calculator to Avoid Exercise – February 5, 2024

When we write covered call options and sell cash-secured puts, our goal is to generate cash-flow in a low-risk manner. Frequently, a second important goal is to avoid exercise...

Read More -

Trading Weekly Options on a 4-Day Trading Week – January 29, 2024

Can we generate meaningful returns writing covered calls or selling cash-secured puts on a 4-day, holiday-shortened trading week? The answer is a resounding yes. This article will focus on a...

Read More -

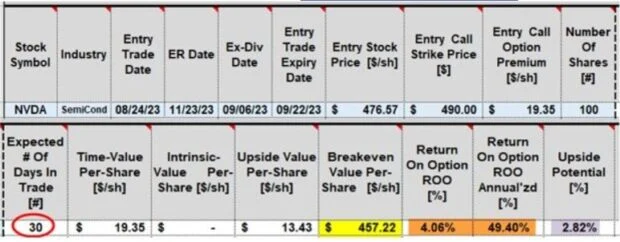

Post-Earnings Opportunities: A Real-Life Example with NVIDIA Corp. (Nasdaq: NVDA) – January 22, 2024

Always avoid having an option in place if there is an upcoming earnings report prior to contract expiration. This applies to covered call writing and selling cash-secured puts as it will avoid the...

Read More -

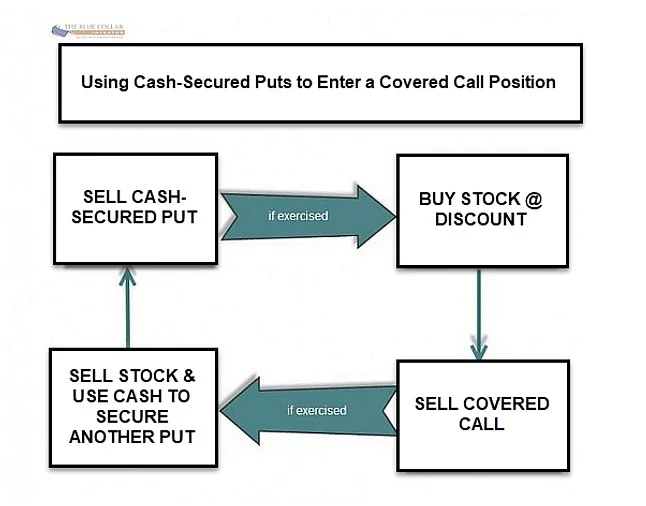

Combining Covered Call Writing and Selling Cash-Secured Puts – January 15, 2024

When we integrate both covered call writing and selling cash-secured puts into one multi-tiered option selling strategy, we have our Put-Call-Put or PCP Strategy. Outside the BCI community, this is...

Read More -

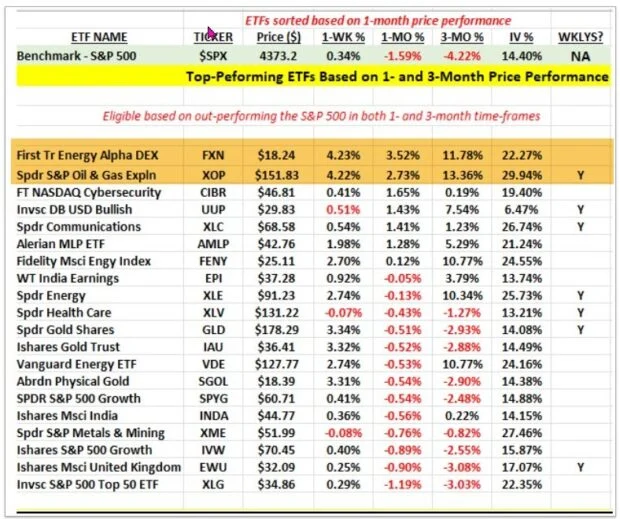

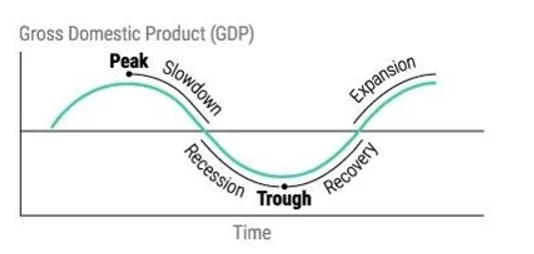

Sector Rotation and the CEO Strategy – January 8, 2024

In 2023, BCI introduced the CEO Strategy, a streamlined approach to covered call writing using the Select Sector SPDRs. This article will explain why sector rotation in our business cycle will create opportunities for this strategy...

Read More -

Whisper Numbers: Another Reason to Avoid Earnings Reports – January 02, 2023

BCI Rule: Never write a covered call or sell a cash-secured put if there is an upcoming earnings report prior to contract expiration. All other parameters in our BCI methodology...

Read More -

Selling Weekly Puts After Disappointing Earnings Reports: A Real-Life Example with Microsoft Corp. (Nasdaq: MSFT) – December 26, 2023

We can leverage our knowledge of cash-secured puts to take advantage of common scenarios. In this article, we will detail how to take advantage of a disappointing earnings report from a...

Read More