-

Buying Back OTM Cash-Secured Puts on Expiration Friday to Avoid Potential Exercise – December 4, 2023

When cash-secured puts are sold, many investors prefer to avoid exercise and having the shares put to them. If the (originally) out-of-the-money (OTM) strike is in-the-money (ITM) as expiration approaches due...

Read More -

Selling Cash-Secured Puts: 2 Favorable Outcomes, November 27, 2023

When we sell cash-secured puts (CSPs), we are getting paid to undertake the contractual obligation to buy the holders shares at a price that we (the sellers) determine, called...

Read More -

Risk-Reward Profile When Rolling-Up Our Cash-Secured Put Trades – November 20, 2023

One of our available cash-secured put trade exit strategies is rolling-up to generate an additional income stream (or multiple income streams). The disadvantage of this position management approach is...

Read More -

How to Manage Near-The-Money Put Strikes as Expiration Approaches – November 13, 2023

Many option traders who sell cash-secured puts prefer not to take possession of the underlying shares. Typically, when a trade is structured, the strike is out-of-the-money (OTM- lower than...

Read More -

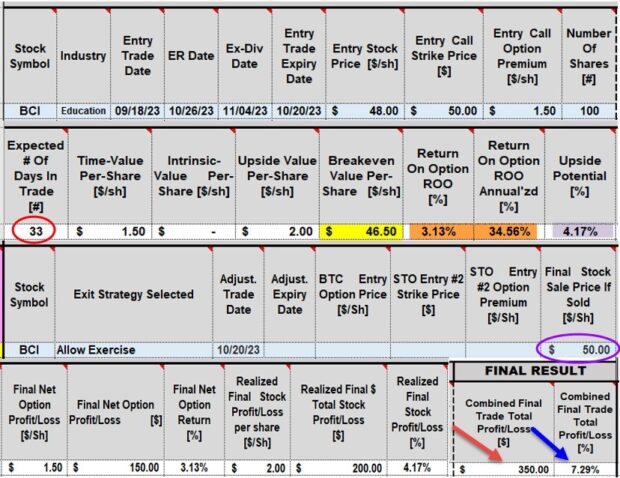

Using the BCI Trade Management Calculator to Mitigate Losses – November 06, 2023

Our covered call writing positions are at risk when share price declines substantially. We do have, however, our exit strategy arsenal to protect against catastrophic losses. This article will show a...

Read More -

How to Calculate Rolling-Up Cash-Secured Put Trades: The BCI Trade Management Calculator + $50.00 Discount Coupon – October 30, 2023

When we roll-up our cash-secured put trades, we are required to place additional cash into our brokerage accounts to secure the higher strike 2nd trade. This article will detail how to...

Read More -

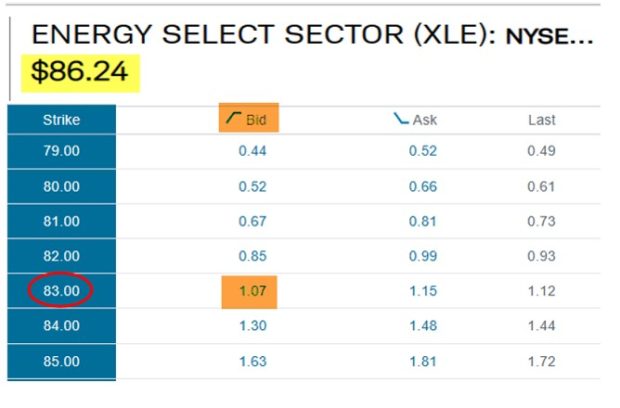

How to Establish a Bear Market Cash-Secured Put Trade – October 23, 2023

In bear and volatile market conditions, we may opt to take a defensive posture with our cash-secured put trades. One technique to accomplish this conservative approach is to use...

Read More -

How to Use Stock Options to Lower Our Breakeven Price Points: The Stock Repair Strategy – October 16, 2023

Stock options can be used to mitigate losses on shares we own at a higher price than current market value. Some investors will buy more shares at the new...

Read More -

Is Covered Call Writing an Option Zero-Sum Strategy? – October 2, 2023

Covered call writing is not a zero-sum strategy. Both the option-seller (call writer … us) and the call buyer can be successful. This article will provide a hypothetical example,...

Read More -

How to Use the BCI Portfolio Setup Spreadsheet to Craft Our Put-Selling Portfolios – September 25, 2023

When we plan our covered call writing and cash-secured puts trades, we must focus in on diversification and cash allocation. In order to accomplish these goals, in April 2023,...

Read More