-

Rolling Out and Up to ITM and OTM strikes: A Real-Life Example with Invesco QQQ Trust (Nasdaq: QQQ) – May 16, 2022

When our covered call writing strikes are expiring in-the-money (ITM), and we want to retain the underlying shares for the next contract period, we can roll the option forward....

Read More -

Determining Our Goal Before Unwinding Both Legs of a Covered Call Trade: A Real-Life Example with Qualcomm Incorporated (Nasdaq: QCOM) + Trade Management Calculator Discount Coupon Expiring Soon – May 09, 2022

When share price accelerates exponentially with our covered call writing stocks, the strike moves deeper in-the-money. Although the intrinsic-value component of the option premium rises, the time-value component approaches...

Read More -

Exit Strategy Considerations When a Strike Moves Deep ITM Early in a Contract – May 2, 2022

When our covered call writing and put-selling trades start out much better than anticipated, Blue Collar Investors immediately evaluate our exit strategy arsenal to see if we can achieve even higher...

Read More -

Analyzing the Cost-To-Close a Covered Call Trade Mid-Contract: A Real-Life Example with NVDIA Corp. (Nasdaq: NVDA) – April 25, 2022

Breaking down the components of a deep ITM strike As the strike moves deeper in-the-money as share price rises, the time-value component of that option premium approaches zero. However, the intrinsic-value component...

Read More -

Rolling-Out to Impressive Profits: A Real-Life Example with NVIDIA Corp. (Nasdaq: NVDA) – April 18, 2022

Exit strategies for covered call writing will elevate returns and mitigate losses. When share price accelerates dramatically, we can take advantage of these opportunities by rolling our options out...

Read More -

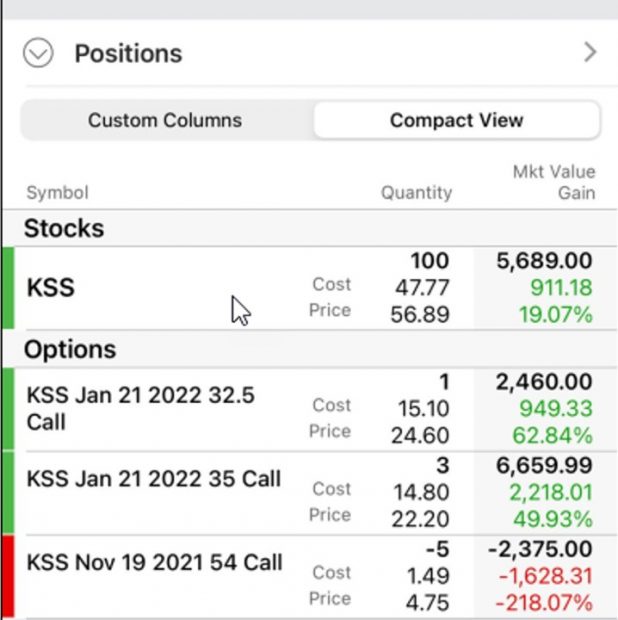

Analyzing a Multi-Faceted Series of Covered Call Trades: A Real-Life Example with Kohl’s Corp. (NYSE: KSS) – April 11, 2022

When we write a covered call option, we first buy a stock or exchange-traded fund (ETF) and then sell the call option which is protected by first owning the underlying security....

Read More -

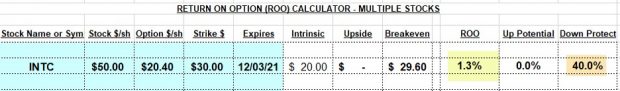

Large Returns Can Be Enticing: We Must Do the Math to Make Sensible Trades – April 4, 2022

Our covered call writing and put-selling trades initially generate cash into our brokerage accounts. The amount of cash can be impressive on the surface but we must break down...

Read More -

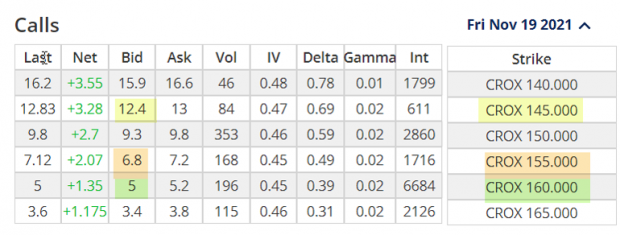

Covered Call Writing Strike Selection in Bull, Bear and Neutral Markets: A Real-Life Example with Crocs, Inc. (Nasdaq: CROX) – March 28, 2022

Covered call writing strike selection will vary from investor-to-investor. There is no single parameter that will guide us to the most appropriate strikes for our portfolios. Factors that must...

Read More -

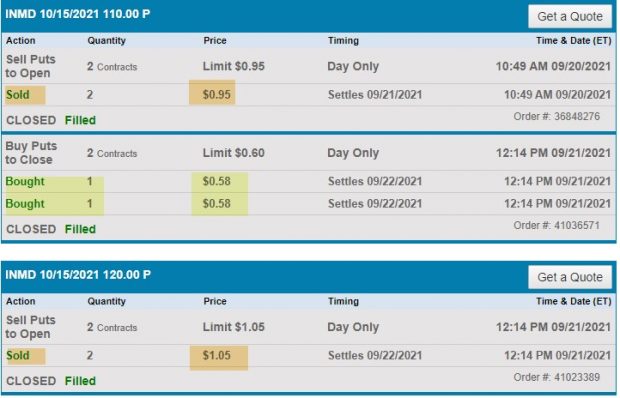

A 6-Income Stream Monthly Cash-Secured Put: A Real-Life Example with InMode Ltd. (Nasdaq: INMD) – March 21, 2022

Is it true that when we sell cash-secured puts, our maximum return is the initial put premium? Come on now, we’ve all heard and read that statement. This article...

Read More -

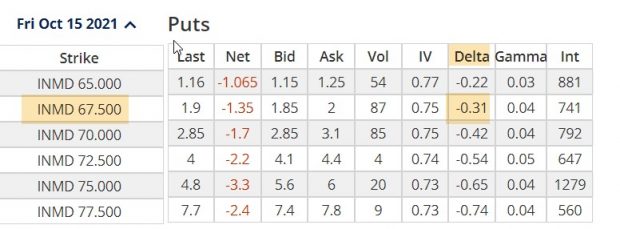

What is a Delta-Neutral Portfolio?: A Real-Life Example With InMode Ltd. (Nasdaq: INMD) – March 14, 2022

Many portfolio managers will seek Delta-neutral portfolios to mitigate directional or market risk. This article will explain how these experts calculate their positions to achieve this goal. To simplify the details,...

Read More