-

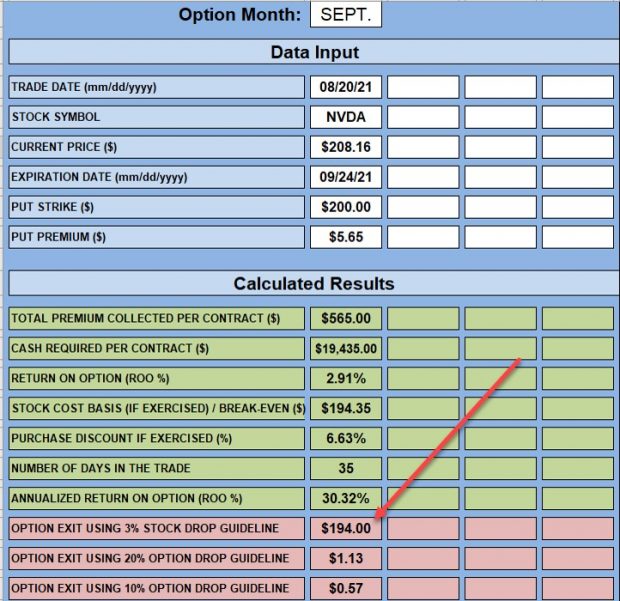

Selling Cash-Secured Puts Exit Strategies: The 3% Guideline: A Real-Life Example with NVIDIA Corp. (Nasdaq: NVDA) – December 20, 2021

When we sell cash-secured puts, we must use all 3 of our required skills: stock (or ETF) selection, option selection and position management. Once we have selected an elite-performing...

Read More -

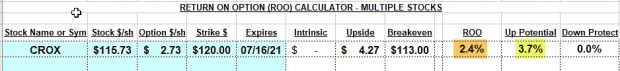

Holding a Stock Through an Earnings Report Can Result in Impressive Returns: A Real-Life Example with Crocs, Inc. (Nasdaq: CROX)- December 13, 2021

One of the golden rules of the BCI methodology is never to sell an option (call or put) when there is an earnings report due out prior to contract expiration. Most of the...

Read More -

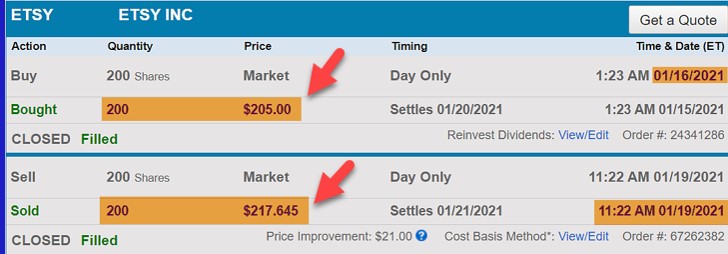

Was I Correct to Close My Successful Covered Call Trade? A Real-Life Example with Revolve Group, Inc. (NYSE: RVLV) – December 6, 2021

Alan K asked me to analyze a series of covered call trades he executed with RVLV over a 4-day period. Share price accelerated substantially once the trade was entered...

Read More -

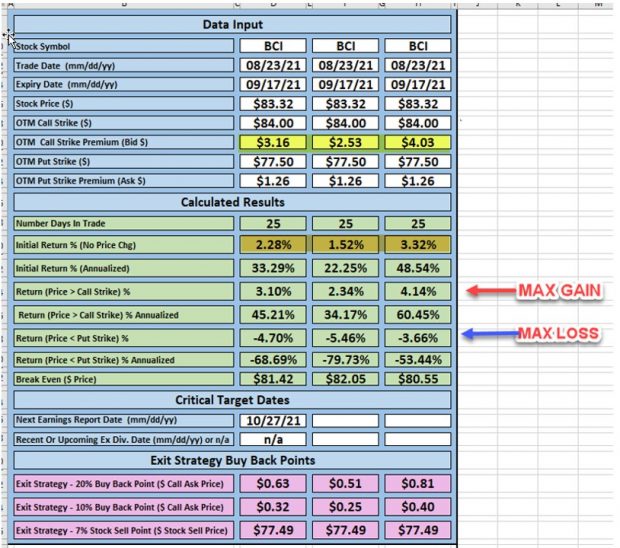

Analyzing Covered Call Writing Trades to Enhance Our Trading Skills: A Real-Life Example with The Clorox Company (Nasdaq: CLX) – November 29, 2021

One of the best ways to elevate our option-selling results is to analyze real-life trades. On August 3, 2021, Mark shared with me a series of trades he executed...

Read More -

Game Plan When Our Cash-Secured Puts are Exercised – November 22, 2021

When we sell cash-secured puts, we have selected a stock or ETF based on sound fundamental, technical and common-sense principles. We generally select out-of-the-money put strikes that meet our...

Read More -

Monitoring Our Collar Trades with the BCI Collar Calculator – November 15, 2021

The collar trade is a covered call writing trade with a protective put. The active leg of the trade is the short call. When exit strategy opportunities present, we make the appropriate trade adjustments....

Read More -

Rolling-Down to an ITM Strike in the Last Week of a Monthly Contract – November 8, 2021

When we roll-down our covered call trades, we generally do so to an out-of-the-money (OTM) strike to allow for share price recovery. However, in the final week of a...

Read More -

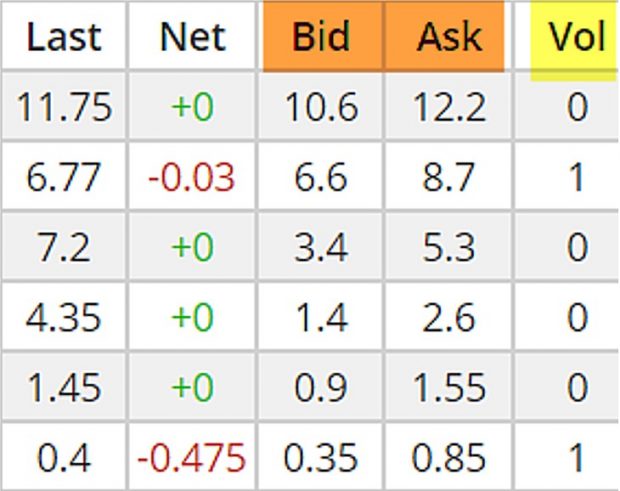

After-Hours and Pre-Monday Morning Market Trading Bid-Ask Spreads – November 1, 2021

Many members of our BCI community have commented on the wide and, therefore, unfavorable bid-ask spreads that are published before the markets open and after they close. This article will explain...

Read More -

Should Good News Discourage Us From Entering a Covered Call Trade? – October 25, 2021

We examine the BCI Premium Stock Report on the Sunday May 23, 2021, after expiration Friday, for our Monday trade selections. One of the securities we choose is Applied Materials, Inc. (Nasdaq:...

Read More -

Explaining “Bought-Up” Value When Rolling a Covered Call Out-And-Up – October 18, 2021

One of our key covered call writing exit strategies is rolling an option when the strike is in-the-money at expiration and we want to retain our shares. We can roll-out to...

Read More