-

Application of the 20%/10% Guidelines Within a Broad Range of Implied Volatility Securities – August 16, 2021

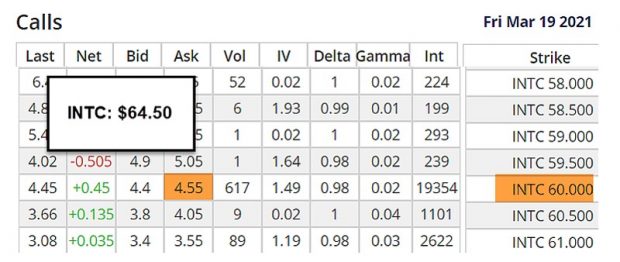

I recently published an article titled Managing Implied Volatility Risk by Establishing an Initial Time-Value Return Goal Range. This article served as a catalyst for several inquiries from our members asking...

Read More -

Managing Implied Volatility Risk by Establishing an Initial Time-Value Return Goal Range – August 9, 2021

When screening for eligible securities for covered call writing and selling cash-secured puts, we must establish how much risk we are willing to incur. There is no right or...

Read More -

Rolling Covered Calls Out-And-Up Means Adding Cash to the Position – August 2, 2021

One of the covered call writing exit strategies in our arsenal as expiration approaches is rolling in-the-money strikes out-and-up. This involves buying back the near-month strike and selling a...

Read More -

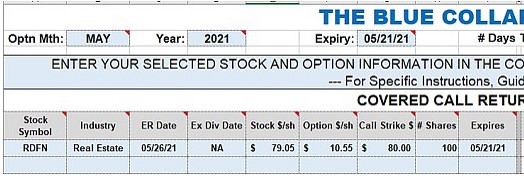

Using the Elite-Plus Calculator for “Hitting a Double” Results: A Real-Life Example with Redfin Corp. (NASDAQ: RDFN) – July 26, 2021

One of the covered call writing exit strategies available to us is hitting double. In March 2021, Duane shared with me a trade he executed using this strategy and inquired...

Read More -

Understanding Brokerage Statements for Covered Call Writing: A Real-Life Example with Energy Select Sector SPDR ETF (NYSE: XLE) – July 19, 2021

Our covered call writing and put-selling broker statements can be confusing when starting our option-selling careers. This article will detail the first 3 steps of our covered call trades...

Read More -

Reversing Delta with the PCP Strategy: A Real-Life Example with Etsy, Inc. (Nasdaq: ETSY) – July 12, 2021

The PCP Strategy, called the “wheel strategy” outside the BCI community, involves selling cash-secured puts and covered calls. One of the ultra low-risk strategies developed by the BCI team involves...

Read More -

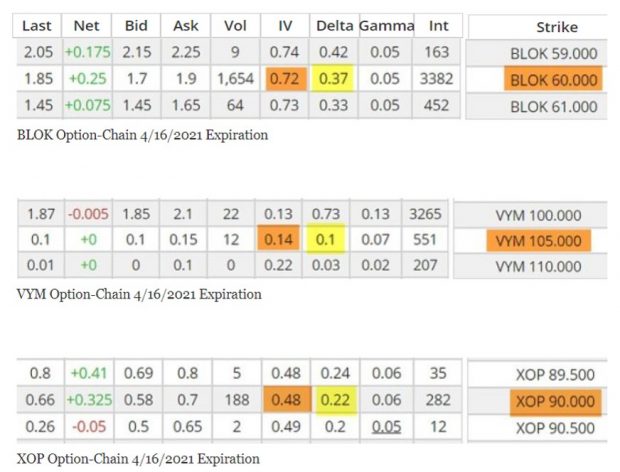

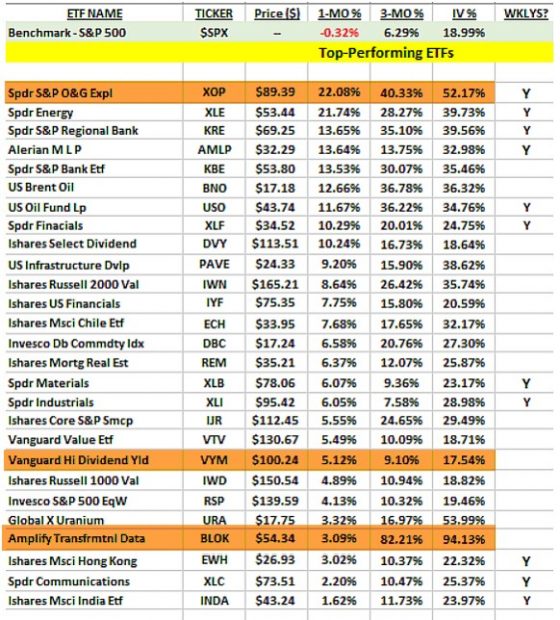

Converting High Volatility ETFs to Conservative Cash-Generating Positions: A Real-Life Example with Global X Lithium & Battery Tech ETF (NYSE: LIT) – July 6, 2021

The covered call writing and put-selling premiums we receive are directly related to the implied volatility (IV) of the underlying securities. This is true of both stocks and exchange-traded funds (ETFs)....

Read More -

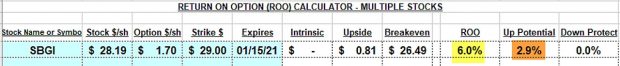

Analyzing a Rolling-Up Covered Call Writing Trade: A Real-Life Example with Sinclair Broadcast Group, Inc. (NASDAQ: SBGI) – June 28, 2021

Covered call writing exit strategies include rolling-out and rolling-out-and-up but what about rolling-up in the same contract month? On January 4, 2021, Court shared with me a series of...

Read More -

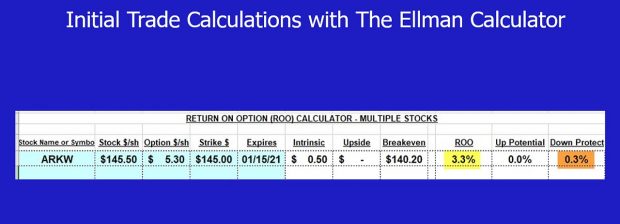

Unusual Strike Prices and Contract Adjustments: A Real-Life Example with ARK Next Generation Internet ETF (NYSE: ARKW) – June 21, 2021

We enter a covered call writing trade for a particular strike and then that strike disappears. What happened? Is this a bad dream? Actually, this is a bit unusual...

Read More -

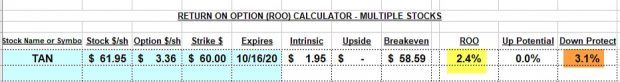

Understanding the Math of Unwinding Covered Call Writing Trades Early: A Real-Life Example with Invesco Solar ETF (NYSE: TAN) – June 14, 2021

On October 6, 2020, Alex from Mexico shared with me a covered call writing trade he executed with TAN. He was considering unwinding the trade using our mid-contract unwind...

Read More