-

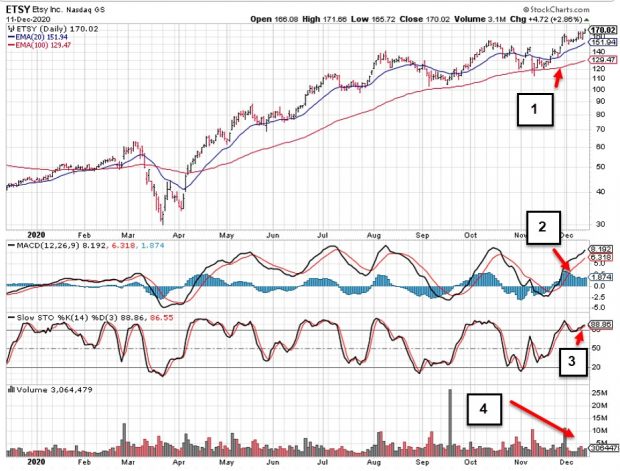

Selecting the Best ITM Strikes for Covered Call Writing: A Real-Life Example with Etsy, Inc. (Nasdaq: ETSY) – June 7, 2021

In challenging market environments, we favor in-the-money strikes for our covered call trades. The intrinsic-value component of our option premiums will provide additional downside protection and lower the breakeven price point...

Read More -

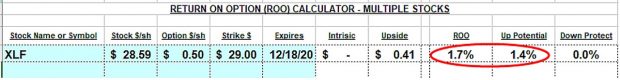

Dividends and After-Hour News Causing Exercise of OTM Call Strikes: A Real-Life Example with Financial Select Sector SPDR Fund (NYSE: XLF) – June 1, 2021

On December 21, 2020, Donna shared with me a successful trade she executed with XLF. What made this trade interesting was that the option was exercised after expiration when...

Read More -

Using Delta to Create Low-Risk/ High-Return Put-Selling Trades: A Real-Life Example with ETSY, Inc. (NASDAQ: ETSY) – May 24, 2021

When selling cash-secured puts, our strikes are selected based on our initial time-value return goal range and personal risk-tolerance. In the BCI methodology, we use only out-of-the-money (OTM) cash-secured...

Read More -

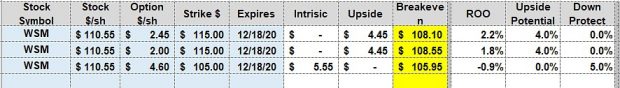

Status of a Rolling-Down Trade with Williams-Sonoma, Inc. (NYSE: WSM) – May 17, 2021

Exit strategies for covered call writing is a critical element necessary to maximize our returns. In December 2020, Alan K shared with me a rolling-down trade he executed with...

Read More -

How to Set Up a Portfolio of Nasdaq and S&P 500 Stocks in a User-Friendly Approach – May 10, 2021

Covered call writers and sellers of cash-secured puts know the importance of portfolio diversification. If one security under-performs, the others can compensate. This article will demonstrate how to craft...

Read More -

Holding a Stock Through an Earnings Report: A Real-Life Example with Atlassian Corp. (Nasdaq: TEAM) – May 3, 2021

Covered call writers are frequently faced with scenarios when earnings reports are due out on securities where we have long-term bullish assumptions. In October 2019, Mark shares with me a dilemma...

Read More -

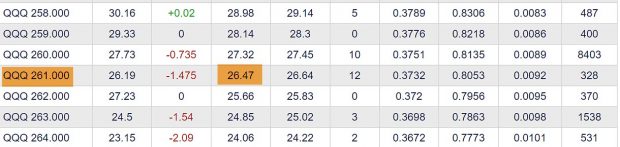

Using the Nasdaq-100 Volatility Index (VOLQ) in Covered Call Writing Decisions: A Real-Life Example with Invesco QQQ Trust (Nasdaq: QQQ) – April 26, 2021

One of the most popular exchange-traded funds (ETFs) used as underlyings for covered call writing is Invesco QQQ Trust (Nasdaq: QQQ) which consists of 100 of the largest domestic and international non-financial companies...

Read More -

What is a SPAC (Special Purpose Acquisition Company)? – April 19, 2021

Are SPACs reliable candidates for our covered call writing and put-selling portfolios? This article will define and explain the anatomy of a SPAC so we can decide if they deserve a...

Read More -

Should I Roll-Out When My Option is DITM Mid-Contract? – April 12, 2021

Exit strategy opportunities for covered call writing must be recognized and acted upon when indicated. It is important to understand when and how to react to these situations and...

Read More -

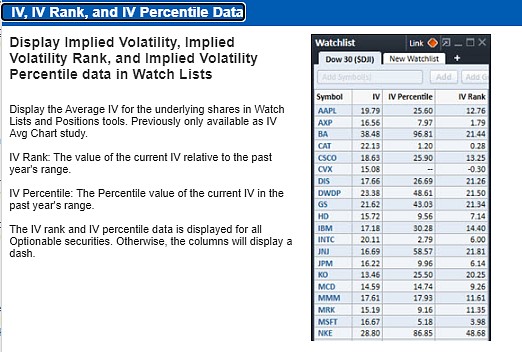

Implied Volatility (IV), IV Rank and IV Percentile: Defined and Practical Applications – April 5, 2021

When writing covered calls and selling cash-secured puts, the implied volatility of the underlying securities is directly related to the premiums we receive and also measures the risk we...

Read More