-

Can We Generate Significant Profits Selling Weekly Covered Calls During a 4-Day Trading Week? – May 6, 2024

Some members of our BCI community have expressed to me that meaningful income cannot be generated selling weekly covered call or put options during a holiday-shortened trading week. This...

Read More -

Selling In-The-Money Cash-Secured Puts to Buy a Stock at a Discount – April 29, 2024

When we sell cash-secured puts, we have 2 possible outcomes. If unexercised, we generate cash flow or, if exercised, we buy the underlying security at a discount. This article...

Read More -

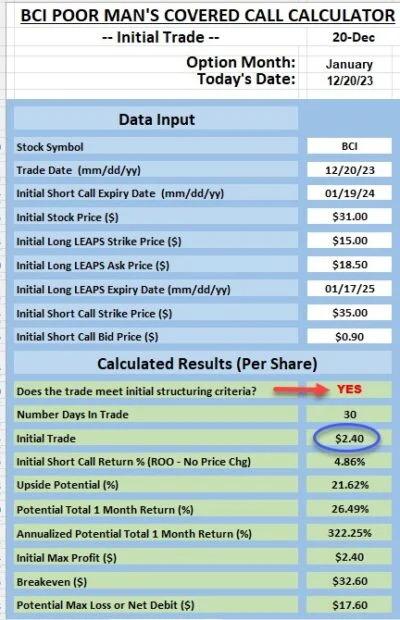

The Poor Man’s Covered Call Trade Initialization Formula – April 22, 2024

The Poor Man’s Covered Call (PMCC) is a covered call writing-like strategy where LEAPS options are purchased instead of actual stocks or exchange-traded funds (ETFs). Weekly or monthly short calls are...

Read More -

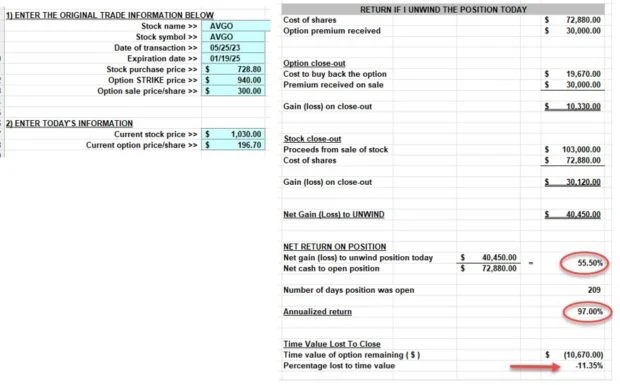

Evaluating the Time Value Cost-To-Close to Assist in Covered Call Trade Decisions – April 15, 2024

We enter a covered call trade and share price rises exponentially, leaving the strike deep in-of-the-money (ITM). Should we close the position since we cannot benefit from additional share...

Read More -

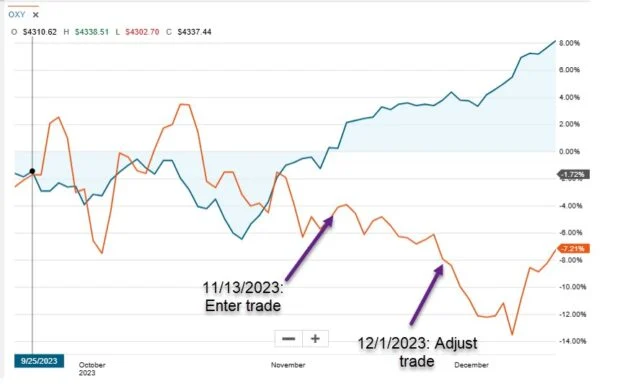

Analyzing and Correcting Our Covered Call Writing Mistakes – April 8, 2024

When we execute our covered call writing trades, we base our decisions on sound fundamental, technical and common-sense principles. To master our option strategies and elevate our returns to...

Read More -

Rolling-Out-And-Up to In-The-Money Strikes – April 1, 2024

Using covered call writing exit strategies is an essential skillset needed to achieve the highest possible returns. The calculations for rolling-out-and-up to in-the-money call (ITM) strikes is a bit more complicated...

Read More -

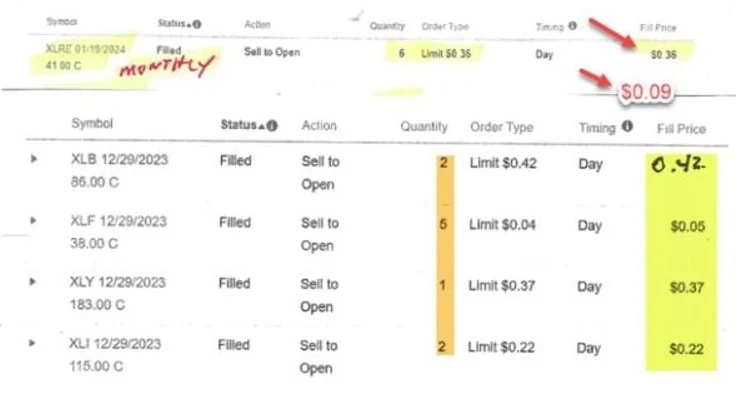

Annualized Returns for Weekly and Monthly Options March 25, 2024

Over the years, I have presented the pros & cons of weekly options versus monthly expirations for our covered call writing and put-selling trades. One of the advantages to...

Read More -

Calculating Covered Call Writing & Cash-Secured Put Trades for the Same Stock and Similar Moneyness – March 18, 2024

Should I write a covered call or sell a cash-secured put on an elite-performing stock or ETF? I use both but slightly favor covered call writing. Both have worked...

Read More -

Using Technical Analysis to Enhance Our Covered Call Writing and Cash-Secured Put Trades – March 11, 2024

In our BCI methodology, there is a 3-pronged approach to our stock screening process: This article will focus on technical analysis and will utilize real-life examples with bullish, mixed...

Read More -

Rolling-Out Decisions for Our Covered Call Writing Trades: 3 Strategies Analyzed – March 4, 2024

When our covered call writing strikes are expiring in-the-money (with intrinsic-value), our shares will be sold at the strike price. We may opt to retain the shares by rolling the...

Read More