-

How to Use the BCI Portfolio Setup Spreadsheet to Craft Our Put-Selling Portfolios – September 25, 2023

When we plan our covered call writing and cash-secured puts trades, we must focus in on diversification and cash allocation. In order to accomplish these goals, in April 2023,...

Read More -

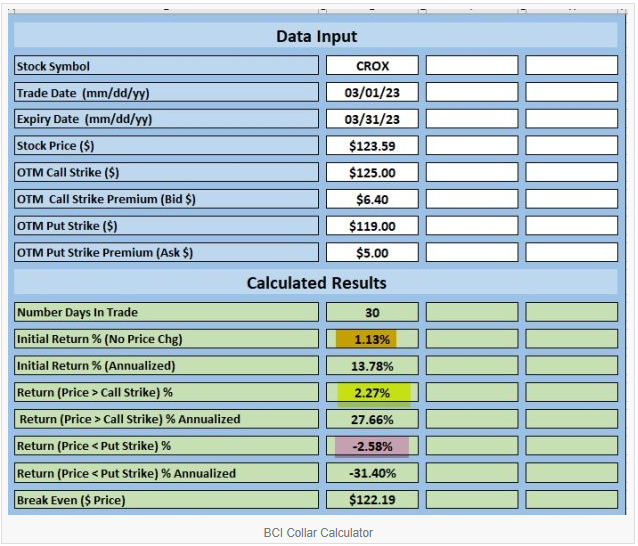

Collar Calculations Using the BCI Trade Management Calculator – September 18, 2023

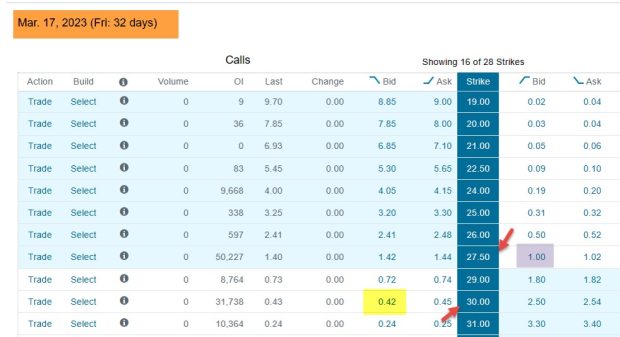

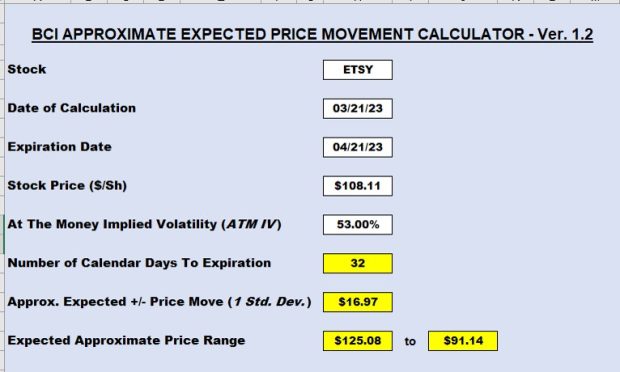

The Collar Strategy is a covered call writing-like strategy where a protective put is added to the trade, thereby establishing a floor and a ceiling with a maximum gain and a maximum loss....

Read More -

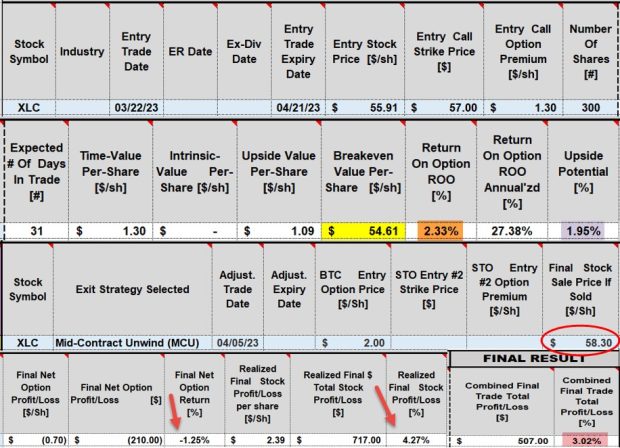

When Should I Take My Profits with a Successful Covered Call Writing Trade? – September 11, 2023

Which %, if any, of our original covered call writing initial time-value return, should we use to close both legs of the trade, and guarantee a realized return? 60%?...

Read More -

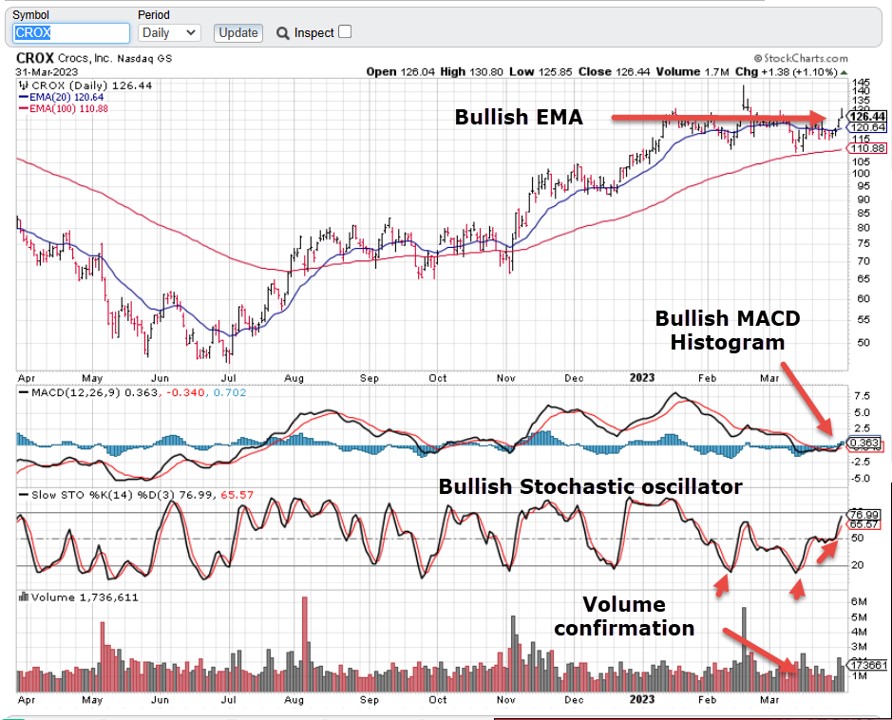

Using Technical Analysis for Our Stock & Option Selection in Covered Call Writing Trades – September 02, 2023

In our BCI methodology, we have a 3-pronged approach to stock selection for our covered call writing trades: We use a mosaic of all 3 parameters for our choices,...

Read More -

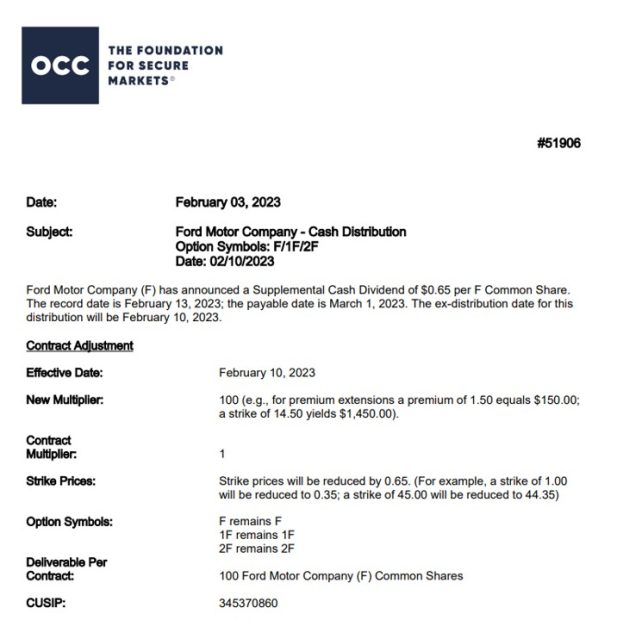

How Our Covered Call Trades are Impacted When Regular and Special 1-Time Cash Dividends Come on the Same Day – August 28, 2023

The parameters of our covered call trades are often changed when certain corporate events result in option contract adjustments. These events include stock splits, mergers & acquisitions as well as special 1-time...

Read More -

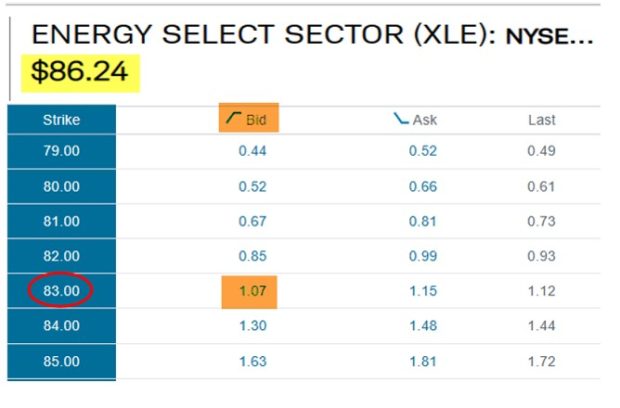

Comparing Covered Call Writing & Cash-Secured Puts in Bull Market Environments – August 21, 2023

Covered call writing versus cash-secured puts in bull markets … which is better? This article will present the arguments for both and make a case why I prefer covered...

Read More -

Selecting the Best LEAPS Strike for an AAPL Poor Man’s Covered Call Trade – August 14, 2023

The Poor Man’s Covered Call (PMCC) is a covered call writing-like strategy where deep in-the-money (ITM) LEAPS options replace the long stock positions. LEAPS have expirations of greater than 1 year. Once the...

Read More -

What is the Single Best Delta to Use When Selecting My Covered Call Writing Strikes? Answer: None – August 7, 2023

This is one of the most frequently asked questions I receive from covered call writers all over the world. Should I use a 40-Delta? 35-Delta? Higher? Lower? The focus...

Read More -

The Collar Strategy: 2 BCI Spreadsheets: A Real-Life Example with Crocs, Inc. (Nasdaq: CROX) – July 31, 2023

The collar strategy is a covered call writing-like strategy where a protective put is added to the covered call trade, creating a 3-leg trade. BCI has developed 2 calculators that can...

Read More -

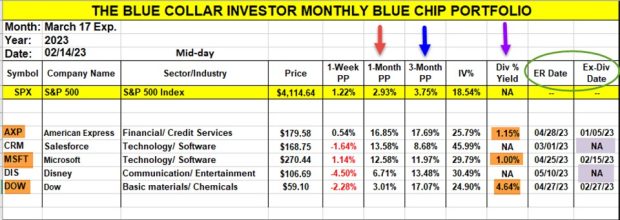

How to Create 3-Income Producing Portfolios Using Covered Call Writing and Dividend Generating Stocks – July 24, 2023

Covered call writing is a low-risk cash-flow strategy that can also create the potential of a 2nd income stream when using out-of-the-money (OTM) strikes which can also produce potential income from...

Read More